Banking

Notes from the khan academy playlist Money and Banking. This came out in October 2008, so it offers a nice overview at a critical time.

Banking 1 - Motivating Example

Let’s say there are two groups of people:

- Hardworking People - This group saves money (or gold) they earn from providing goods and services.

- Entrepreneurs - This group has ideas for project or investments.

The hardworking people are currently storing their money under their bed or burying it in their backyard. The entrepreneurs want to use that money that isn’t being utilized to start a new project – for example to hire people to dig irrigation ditches to increase the amount of crop yield.

Let’s imagine an entrepreneur called Sal. Sal hits three problems when attempting to get funds to start his irrigation project:

- He doesn’t know who has money. People don’t want to broadcast how much money they have for fear of being robbed.

- People don’t know how to evaluate his project. For example, the dentist doesn’t know much about irrigation or farming.

- He would need to convince multiple people to fund his project since the savings from one person wouldn’t be enough.

Sal even says that he will pay people back more than what they put in, but no one bites. He now sees a different problem he can solve–connecting people (and their savings) with entrepreneurs.

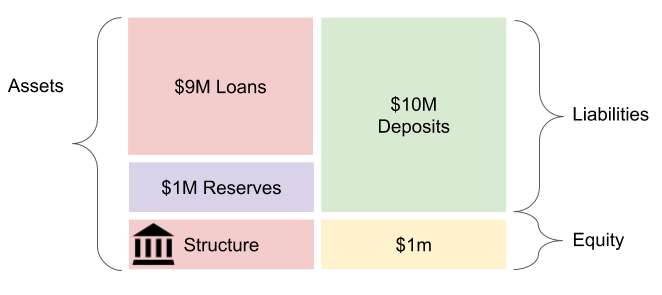

He decides to take $1M of his own money (equity) and build a big, solid, safe vault. He then goes out and convinces people in the community to store their money in the vault instead of putting it under their bed or burying it in the backyard. This results in $10MM of deposits (a liability).

Chances are people won’t come back all at once and request their money, so he keeps 10% ($1M) of it in cash reserves. He now has $9MM that he can lend out to other entrepreneurs. His setup looks like this:

In order to make money, Sal decides to charge 10% interest on the loans he makes and pays out 5% on the deposits he makes. Let’s see what he makes after a year:

| Description | Amount |

|---|---|

| Loans | +900K |

| Deposits | -500k |

| Salaries & Security | -100k |

| TOTAL | +300k |

When the savings are matched up with good investments, everyone benefits. The people get better irrigation, they get interest on their savings, and the entrepreneur gets to make money from the project.

As an aside, everyone thinks gold represents wealth while paper money does not. This is not true, gold is not useful for anything other than being pretty, limited, and hard to counterfeit. Paper money is lighter and hard to counterfeit. Gold is not really better than paper money.

Banking 2 - Income Statement

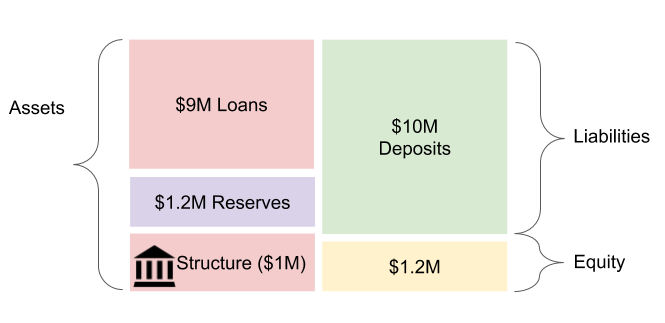

For this section we assume we start with the same balance sheet as banking 1.

At the end of the year, our income statement looks like:

| Description | Amount |

|---|---|

| Interest Income | +900K |

| Interest Expense | -500k |

| Salaries | -50k |

| Upkeep | -50k |

| Pretax Income | +300k |

| Income tax | -100k |

| Net Income | +200k |

Remember that a balance sheet is a snapshot of what you have and what you owe. The income statement tells you what happened over the course of the year.

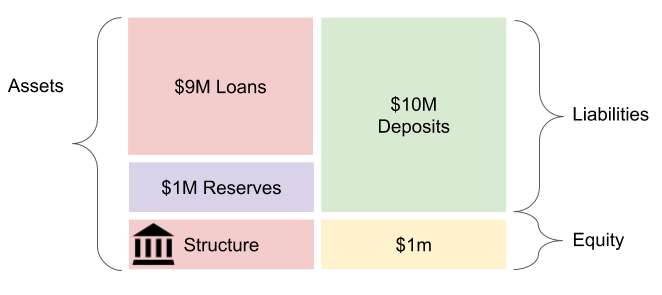

Given that all the loans are still on the balance sheet and they paid interest, the new balance sheet will look like:

What is the new equity? Equity is total assets minus total liabilities.

\[11.2M - 10M = 1.2M\]This means that the change in equity is:

\[1.2M - 1M = 200k\]Change in equity is the same thing as net income.

What is the return on equity?

\[200k / 1M = 20\% ROE\]This is the same thing as Net Income / Avg equity.

Other points

-

Productive capital - a claim on someone’s good and services that can be used to create more value.

-

Money is nothing more than a future claim on goods and services.

-

Deposits are not a loan. They can be withdrawn at any point.

Banking 3 - Fractional Reserve Banking

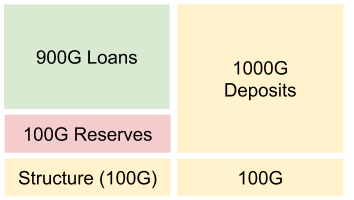

Here we start with a similar setup as the previous examples, but instead of dollars we use gold. For deposits, we say apple farmers deposit 1000G into the bank. We end up with the following balance sheet:

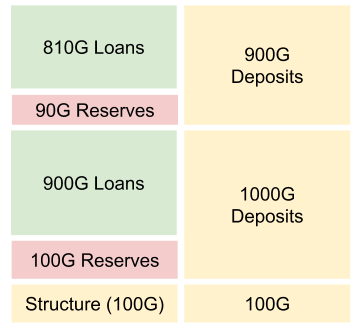

The 1000G of deposits enables the bank to lend out 900G to an entrepreneur starting an irrigation project. The 900G then gets paid to the workers and they deposit it into the bank. After the deposit from the workers, we end up with:

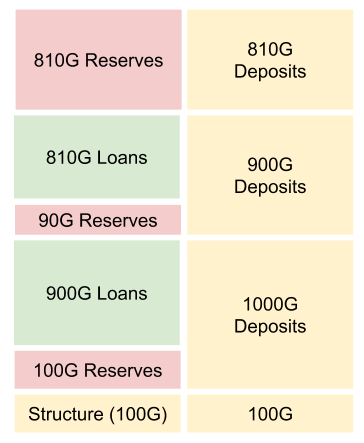

The deposit from the workers lets the bank lend out an additional 810G after they hold 90G in reserve. The bank next lends out 810G pieces to someone who builds the factory. The factory pays their workers and the workers deposit their money back into the bank. The bank could then lend against that deposit, but let’s stop here and say we keep all 810G in reserve. We end up the following balance sheet:

Assets are still equal to liabilities plus equity and the reserves in the above examples are the actual gold coins.

How much money is in the economy? There are a couple ways to answer that question.

First, we can count how much gold is in the system or economy (M0). Since there is only one bank, we can simply count up the reserves. This gives us 810G + 90G + 100G. This gives us 1000G. The same amount that was initially deposited by the farmers.

Second, we can count how much money people think they have in their checking accounts (M1). If we add up the checking accounts: 1000G + 900G + 810G, we get 2710G. This is the multiplier effect and it happens anytime there is a fractional reserve system.